Problem 4:

An entity reported an imprest petty cash fund of 50,000 with the following details:

Currencies 30,000

Coins 4,000

Petty cash vouchers:

Gasoline payments for delivery equipment 4,000

Medical Supplies for employees 5,000

Repairs of office equipment 2,500

Loans to employee 1,500

A check drawn by the entity payable to the order of the petty cash custodian representing salary for the month 20,000

An employee’s check returned by the bank for insufficiency of fund 4,000

A sheet of paper with names of several employees together with contribution for a birthday gift of a co-employee. Attached to the sheet of paper is a currency of 5,000

What amount of petty cash fund should be reported in the statement of financial position?

Currencies 30,000

Coins 4,000

Check drawn as salary 20,000

Petty Cash 54,000

The petty cash vouchers are excluded in the cash and should be recorded as expenses. The check, since it’s just written but not yet given, shall still be part of the petty cash fund. A sheet of paper, or any envelopes related to personal events such as birthdays or weddings of employees just placed inside the petty cash box shall also be excluded, because such currencies do not belong in the bank.

What if there is an envelope which represents a contribution for the birthday gift of a co-employee is included in the petty cash box with the label “$350”, but is already empty? This means that such amount are counted as currencies. However, since they should not be included, they should be deducted from the currencies balance.

Further, if there is an envelope which represents a contribution for the birthday gift of a co-employee is included in the petty cash box with the label “$350” and the money is still in the envelope? This means that the cash was segregated properly from currencies, so the company only need to ignore such balance. Again, it will not be deducted from the currencies balance because the money is still in the envelope and was not included in the count for currencies and coins.

Problem 5:

The following information is shown in the accounting records of Coconut Company:

| January 1 | December 31 | |

| Cash | 186,000 | |

| Accounts Receivable | 210,000 | 230,000 |

| Merchandise Inventory | 250,000 | 234,000 |

| Accounts Payable | 169,000 | 134,000 |

| Prepaid Expense | 120,000 | 108,000 |

Total sales and cost of goods sold for 2018 were P2,493,000 (including 500,000 cash sales) and P1,955,000, respectively. All sales and purchases were made on credit. Various operating expenses of 321,000 were paid in cash. Assume that there were no other pertinent transactions.

What is the cash balance on December 31, 2018 of Coconut Company?

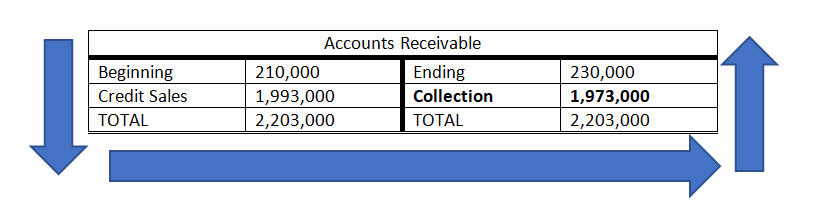

To know the cash balance at the end of the period, we need three things: amount of collection from credit sales, amount of payment for purchases, and amount of payment for operating expenses.

This is a different form of T-account. As a guide, remember the following: For assets, the beginning balance is the normal side balance (left) and the ending balance on the opposite side. Further, add all items on the left side of the t-account, and include all items which reduce the balance at the right side. The totals of left and right sides of the t-account will serve as a checking balance to arrive at the given total.

For the accounts receivable, put first the beginning balance on the left side and the ending balance on the right side. Then, put the credit sales (Total Sales – Cash Sales) on the left side because it increases accounts receivable. We add the beginning and credit sales balance to get the total, and copy the amount to the right side. Lastly, subtract the right side total from the ending balance to get the collected portion.

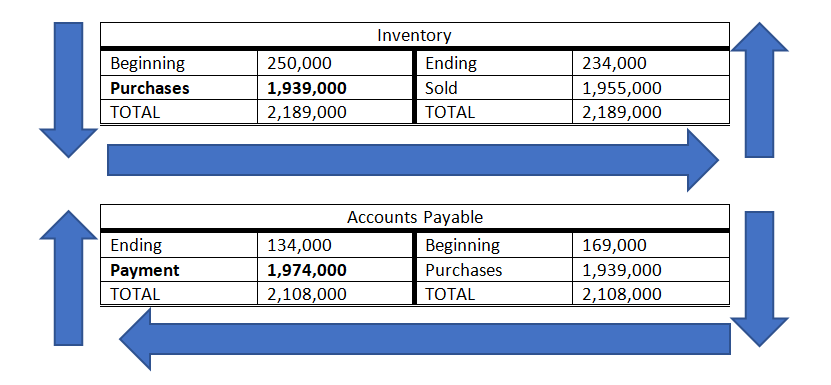

For the accounts payable, we apply the opposite rules. We start the beginning balance on the right side and add credit purchases which increases accounts payable to get the total. We copy the total to the other side. Lastly, we subtract the total from the ending balance to get the payment for purchases.

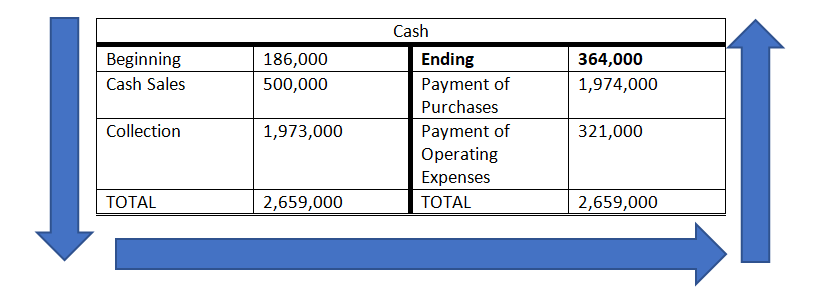

We combine our answers from the previous table to arrive at the balance of cash. We start by putting the beginning balance on the left side, add the cash sales and collection from credit sales since it increases the cash balance. We copy the total on the right side. Then, we subtract the payment of purchases and operating expenses from the total right side to get the ending balance.